What is a PSP in banking?

Payment service providers – also known as merchant service providers or PSPs – are third parties that help merchants accept payments. Simply put, payment service providers enable merchants to accept credit and debit card payments (as well as Direct Debit, bank transfer, real-time bank transfer, etc.)

PSPs, or commonly known as Payment Service Providers, are third parties that help retailers accept payments from their customers.

Square, Stripe, Shopify Payments, Amazon Pay and PayPal are all examples of payment service providers. Also known as third-party payment processors, PSPs allow businesses to accept credit and debit cards, plus other payment types for online, mobile, in-store and recurring payments.

A payment processor acts as an intermediary for an online retailer and card acquirers or banks. A PSP, on the other hand, offers a comprehensive service that includes both technical payment processing and money collecting.

PSP is responsible for authentication of the User at the time of registration of such customer, either through its own app or TPAP's app. PSP engages and on-boards the TPAPs to make the TPAP's UPI app available to the User. PSP has to ensure that TPAP and its systems are adequately secured to function on UPI.

Payment service provider (PSP), payment solution provider, or merchant services provider are synonyms. They describe a financial institution authorized to process money transactions between merchants and their customers.

Payment Service Provider Credit Funds

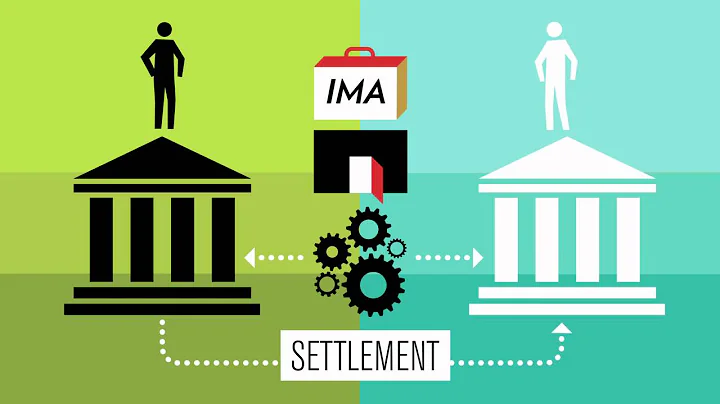

After receiving the funds, the PSP sends the funds to the merchant account. This is known as the settlement. A merchant can opt either for Instant Settlement or for Standard Settlement.

Some PSPs provide services to process other next generation methods (payment systems) including cash payments, wallets, prepaid cards or vouchers, and even paper or e-check processing. PSP fees are typically charged in one of two ways: as a percentage of each transaction, or as a fixed cost per transaction.

Key Characteristics of Quality PSP MOR Pay Type

Well-known payment types and popular service providers, such as PayPal, Venmo or Zelle, also enable automated recurring transactions for monthly subscriptions.

We hereby confirm that: We Amazon Pay (India) Private Limited are a TPAP authorized by NPCI to facilitate payments through Axis Bank Limited. We are a service provider and we participate in UPI through PSP bank. We are bound by the tripartite agreements entered with the PSP Banks and NPCI.

Is PayPal a PSP?

#1) PayPal – The PSP for Low-volume Payment Processing

PayPal is one of the most affordable payment systems that offer credit card processing to all business types. The monthly fee for businesses is low (and there is also a free plan). PayPal is the best pick for low-volume transactions with pay-as-you-go terms.

With a traditional merchant account, the merchant has its own account. A PSP, on the other hand, combines a variety of different merchants under a single umbrella account.

The Acquirer enters the process during the confirmation request of the payment. After having sent the request to the PSP, the PSP forwards the payment information to the Acquirer (who will then redirect the information to the issuer).

Progressive supranuclear palsy (PSP) is a rare neurological condition that can cause problems with balance, movement, vision, speech and swallowing. It's caused by increasing numbers of brain cells becoming damaged over time.

Merchant account providers are typically banks or financial institutions that offer businesses a dedicated merchant account. A merchant account is a specialized account that allows businesses to accept and process electronic payments, such as credit and debit card transactions.

PSPs process large volumes of transactions, which means that money launderers may not stand out from the crowd. In particular, the mixing of payment flows and the fragmentation of the payment landscape offer risks for money laundering.

The lack of awareness of the benefits of new technologies, fear of risk and fraud, resistance to new payment mechanisms, lack of trained key personnel in the organization for marketing purposes is a huge challenge that PSPs have to overcome.

Payment service providers connect merchants, consumers, card brand networks and financial institutions. Payment service providers bring all financial parties together to deliver a simple payment experience for merchants and their customers by processing payments quickly and efficiently.

A payment processor manages the credit card transaction process by acting as the mediator between the merchant and the financial institutions involved. A processor can authorize credit card transactions and works to ensure merchants get paid on time by facilitating the transfer of funds.

- Create your payment gateway infrastructure. You'll need a server to host your gateway, whether it's your own or via a third party. ...

- Choose a payment processor. ...

- Create a customer relationship management (CRM) system. ...

- Implement security features. ...

- Obtain required certifications.

Is Mastercard a PSP?

A PSP service provider is a company that is responsible for the integration of online payment methods in e-commerce stores. PayPal, Mastercard, Visa or American Express stand out. Get to know how they work and much more.

The PlayStation Portable (PSP) is a handheld game console developed and marketed by Sony Computer Entertainment.

The average PSP salary ranges from approximately $38,410 per year (estimate) for a Customer Service Representative to $116,299 per year (estimate) for a Director of Operations.

One of the most notable things that the PSP did better than other handheld consoles was its graphics. The PSP was powered by a custom 333 MHz processor and had a high-resolution 4.3-inch screen, which allowed it to display games with much higher quality graphics than other handheld consoles at the time.

Sure, we could say it was that the PSP's UMD format was limited and never took off, that the disc drive and screen was a battery hog, and that Sony's marketing failed to push the handheld's high-profile games - but in the end, what really killed the PSP was entering the ring at a time when the metaphorical John Cena of ...