What is payment solution in banking?

Payment solutions are electronic equipment and software that process payments for small and local businesses. Different types of payment solutions include point-of-sale (cash registers), and online or mobile payment systems. Customers might pay online, in person, by phone, and by cash, credit, or bank transfer…..

Payment solutions are electronic equipment and software that process payments for small and local businesses. Different types of payment solutions include point-of-sale (cash registers), and online or mobile payment systems. Customers might pay online, in person, by phone, and by cash, credit, or bank transfer…..

A payment gateway is a network that collects, verifies and performs fraud checks on customer's credit card information before sending it to the payment processor. A payment processor is a service that routes a customer's credit card information between the customer's bank and the merchant bank.

Simply put, payment service providers enable merchants to accept credit and debit card payments (as well as Direct Debit, bank transfer, real-time bank transfer, etc.) by connecting them to the broader financial infrastructure.

No, PayPal is not a traditional payment gateway, but it does offer a payment gateway solution (Payflow) as part of its overall payment processing solutions.

Once the payment is verified, funds are passed on to your business bank account. Meanwhile, a payment gateway is the link that makes the connection between a customer's bank and your merchant account, allowing funds to flow into the latter after a payment transaction is cleared.

What are Payment Service Providers (PSPs)? PSPs (also called Merchant Service Providers) are third-party companies that help business owners accept a wide range of online payment methods, like online banking, credit cards, debit cards, e-wallets, cash cards, and more.

Glad you asked! Zelle® is a great way to send money to friends and family, even if they bank somewhere different than you do1. That means it's super easy to get paid back, or split the costs of things like dinner. With Zelle®, the money goes directly into your bank account.

Examples of PSPs include Amazon Pay, PayPal, Stripe, and Square. PSPs are also known as third-party payment processing companies or merchant service providers. Indeed, these payment providers ensure that your transactions are completed securely and efficiently.

Here are the general steps to becoming a payment processor: market research and planning, creating a business plan and registration, compliance and regulations research, building financial partnerships, building technology infrastructure and processing platforms, testing and launching, scaling and expanding.

What is mobile payment solutions?

A mobile payment is a contactless way of paying that involves a mobile device such as a mobile phone, a smartwatch, or a tablet. Mobile payments are typically completed using a digital wallet or mobile app, and can be linked to bank accounts, credit cards, debit cards, and other payment methods.

The PSP sends the details to the card network to verify them, then proceeds to transmit them to the bank, where the bank confirms the payment initiator's account, like the fund sufficiency. Once the bank endorses and approves the payment, it sends the information to the card network and the payment service provider.

Some PSPs provide services to process other next generation methods (payment systems) including cash payments, wallets, prepaid cards or vouchers, and even paper or e-check processing. PSP fees are typically charged in one of two ways: as a percentage of each transaction, or as a fixed cost per transaction.

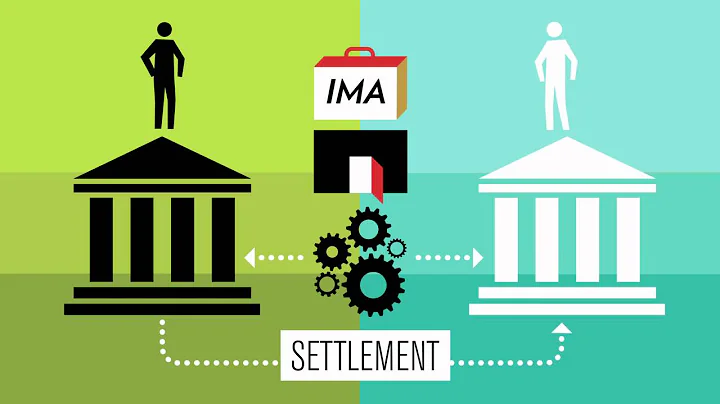

PSPs process and manage the entire transaction, actually moving the funds from one account to the other, and serve as a mediator between the Issuing bank, card/payment network and Acquiring bank.

You can take online credit and debit card payments with both QuickBooks Online and QuickBooks Money. If you need to key cards in manually or track in-person payments, you can download the QuickBooks GoPayment app on its own, or download it and sync it to QuickBooks Online to do accounting.

You can pay bills directly from QuickBooks with your bank account, debit or credit card. You can choose how your vendors receive their payment by ACH or check. Once you schedule your bills they automatically show as paid in QuickBooks. Your other users won't accidentally pay them later.

In general, credit and debit cards are the most widely used payment method.

PayPal is not a bank and does not itself take deposits. You will not receive any interest, credit, or other earnings on the funds in your PayPal Balance account or Venmo account. FDIC insurance does not protect you against the failure of PayPal or Venmo.

PayPal savings account deposits are FDIC-insured and held by Synchrony Bank. If a program bank holds your PayPal balance, any time you add funds to or receive money in your PayPal account, that money is automatically moved to the program bank by PayPal.

While PayPal is not a bank, it collaborates with banks such as The Bancorp Bank and Synchrony Bank to provide products such as debit cards, prepaid cards, credit cards, and lines of credit. PayPal allows you to link an external bank account, credit card, or debit card and use the service to securely shop online.

What is a disadvantage of payment gateway?

Disadvantages. Payment gateways can be expensive. Transaction fees are usually charged on each transaction and additional monthly fees may apply. Payment gateways may require merchants to organise their own PCI compliance.

Cost or pricing is a significant consideration when choosing a payment gateway. Evaluate the types of fees, including setup fees, monthly fees, and transaction fees. Some gateways offer a zero setup cost option, like Razorpay, which can be advantageous for startups and small businesses.

A payment gateway is a technology platform that acts as an intermediary in electronic financial transactions. It enables in-person and online businesses to accept, process, and manage various payment methods—such as credit cards, debit cards, and digital wallets—in a secure and efficient manner.

Merchant onboarding with Stripe: How to get started

Like other PSPs, Stripe requires new businesses to verify their identity as part of the KYC process.

Square, Stripe, Shopify Payments, Amazon Pay and PayPal are all examples of payment service providers. Also known as third-party payment processors, PSPs allow businesses to accept credit and debit cards, plus other payment types for online, mobile, in-store and recurring payments.